massachusetts estate tax table

If youre responsible for the estate of someone who died you may need to file an estate tax return. By following the same method described in the Massachusetts Estate Tax section you can use the table below to figure out your federal estate tax burden.

Massachusetts Estate Tax Everything You Need To Know Smartasset

It is 45 smaller than the overall US.

. Once the Filing Threshold is surpassed the entire gross estate is subject to tax based on a progressive rate table with tax rates ranging from 08 to. 2020 sales tax rates. A local option for cities or towns.

A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. North Carolinas 25 percent corporate tax rate is the lowest in the country followed by Missouri 4 percent and North Dakota 431 percent. Find out if you qualify for property tax relief for seniors in Massachusetts.

A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. If you forgot to file a 2021 Schedule CB with your 2021 Massachusetts personal income tax return you should file an amended return with your 2021 Schedule CB and complete the following. It can be used for the property you own rent or occupy as your main residence.

Your employer has until Jan. 2020 sales tax rates differ by state but sales tax bases also impact how much revenue is collected and how it affects the economy. Call 800-829-3676 to order.

Sales tax on marijuana. Adult use marijuana is subject to. Boston-area historical tornado activity is near Massachusetts state average.

Sales tax on meals prepared food and all. A state excise tax. Death benefits arent normally subject to income tax but they can add to the value of the decedents estate and become subject to the federal estate tax.

That results in a total tax of 345800 on the first 1 million which is. Elderly people living in the Bay State can apply for a refundable credit for the paid real estate taxes. For more information visit E-file and Pay Your MA Personal Income Taxes.

Wind speeds 207-260 mph tornado 221 miles away from the Boston city center killed 90 people and injured 1228 people and caused between 50000000 and 500000000 in damages. A estate tax is levied on an heirs inherited portion of an estate if the value of the estate exceeds an exclusion limit set by. The estate tax in the United States is a federal tax on the transfer.

This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and Rhode Island. Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax. If an estate exceeds that amount the top tax rate is 40.

See potential recreational marijuana tax revenue by state. DOR prior year returns are. Massachusetts 104 21 Alaska 104.

As noted above a certain amount of each estate is exempted from taxation by the law. DOR 2021 paper returns are available. 2022 Property Tax Rates for Massachusetts Towns.

Real estate tax bills andor the actual tax paid or proof of rent paid. Deadline to pay the fourth-quarter estimated tax payment for tax year 2021. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

Seven other states impose top rates at or below 5 percent. DORs Division of Local Services has developed taxpayer guides to real estate tax exemptions in Massachusetts for. The table of contents inside the front cover the introduction to each part and the index in the back of the publication are useful tools to help you find the information you need.

Note that for this tax only the amount above the exemption is taxed. Ordering tax forms instructions and publications. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

If youre responsible for the estate of someone who died you may need to file an estate tax return. Deadline for employees who earned more than 20 in tip income in December to report this income to their employers on Form 4070. An exemption is a release or discharge from the obligation to pay all or a portion of a local property tax.

January to March. A full chart of federal estate tax rates is below. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000.

On 691953 a category F4 max. Fill in the Amended return oval on your income tax return and submit. Click table headers to sort.

Life insurance proceeds are tax-free to some extent but that isnt always the case. As the table below shows the first 1 million is taxed at lower rates from 18 to 39. 2021 Form 1.

Take a look at the table. A state sales tax. Currently 28 states allow for the transfer or assignment of delinquent real estate tax liens to the private sector according to the National Tax Lien Association a.

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Massachusetts Resident Income Tax Return. The following table shows average potential revenue generation calculated based on the average dollars collected in fiscal year FY 2020 per estimated user of marijuana in states that have had a legal market for three years or longer.

Per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s while per capita sales in border counties in Vermont have remained stagnant. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. Its paid by the estate and not the heirs although it could reduce the value of their inheritance.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. An inheritance tax is a tax on the property you receive from the decedent. Go to IRSgovOrderForms to order current forms instructions and publications.

Massachusetts NonresidentPart-Year Tax Return. Florida 4458 percent Colorado 455 percent Arizona 49 percent Utah 495 percent and Kentucky Mississippi and South Carolina 5 percent. Below is a table of the amount of exemption by year an estate would expect.

Connecticut Delaware Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island. Form 706 is filed by the executor of the estate if the decedent has passed during the tax year and the estate value exceeds a certain threshold. To file Form 706 in 2021 the combination of the gross value of the estate and the value of.

That would occur if certain rules werent met and the overall value of the estate exceeds the annual federal estate tax. Qualifying Surviving Spouses Minor Children and Elderly Persons. 31 to send you your W-2 form reporting your 2021.

An estate tax is a tax on the value of the decedents property. A simple guide to property tax exemptions in MA. As noted above the Internal Revenue Service IRS requires estates with combined gross assets and prior taxable gifts exceeding 1170 million for the 2021 tax year to.

Electronic Filing E-Filing E-Filing for DOR and the IRS begins January 24 2022.

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Estate Tax Everything You Need To Know Smartasset

What Is An Estate Tax Napkin Finance

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Income Tax H R Block

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State And Local Sales Taxes Work Tax Policy Center

Where Not To Die In 2022 The Greediest Death Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

A Guide To Estate Taxes Mass Gov

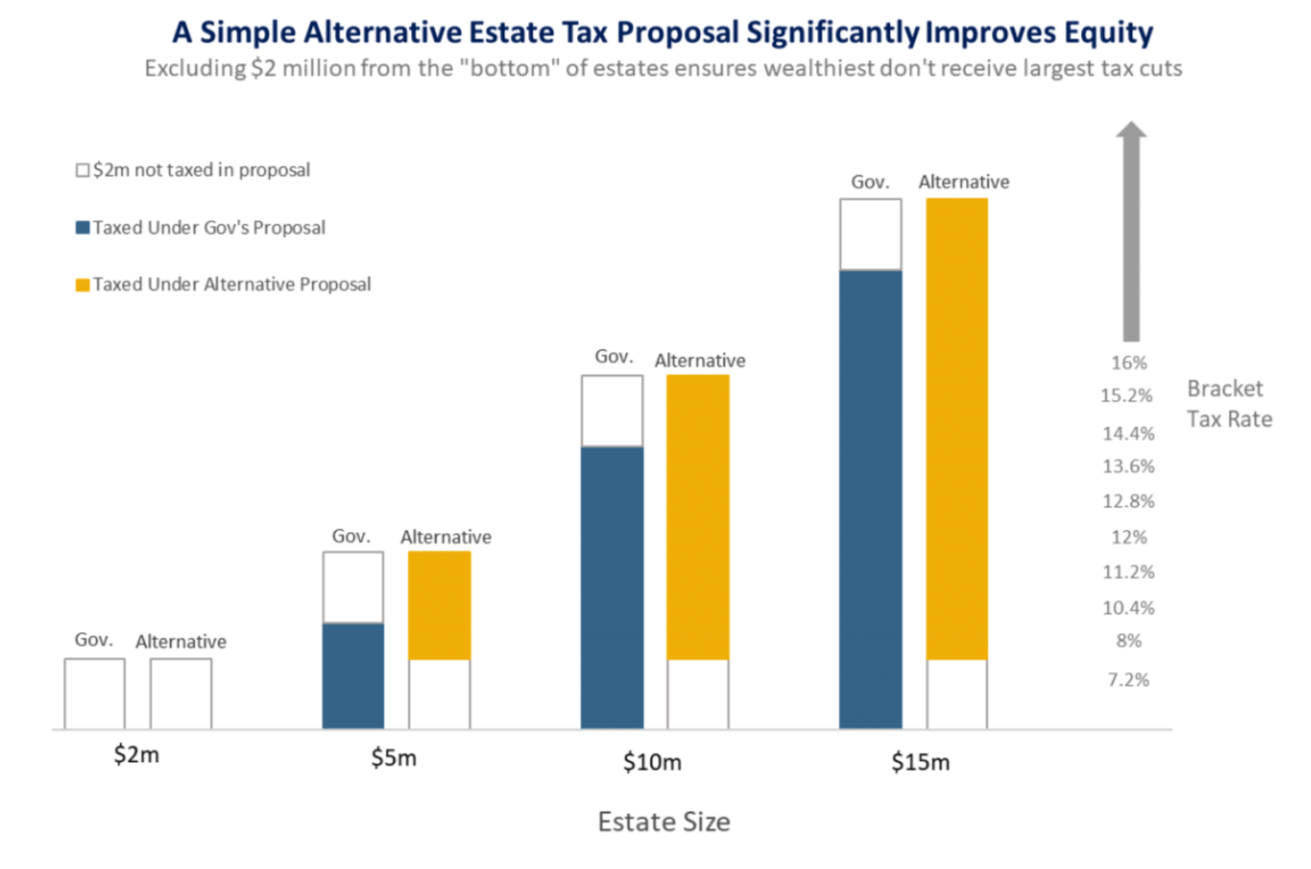

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

What Are Estate And Gift Taxes And How Do They Work

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation